50/30/20 budget example

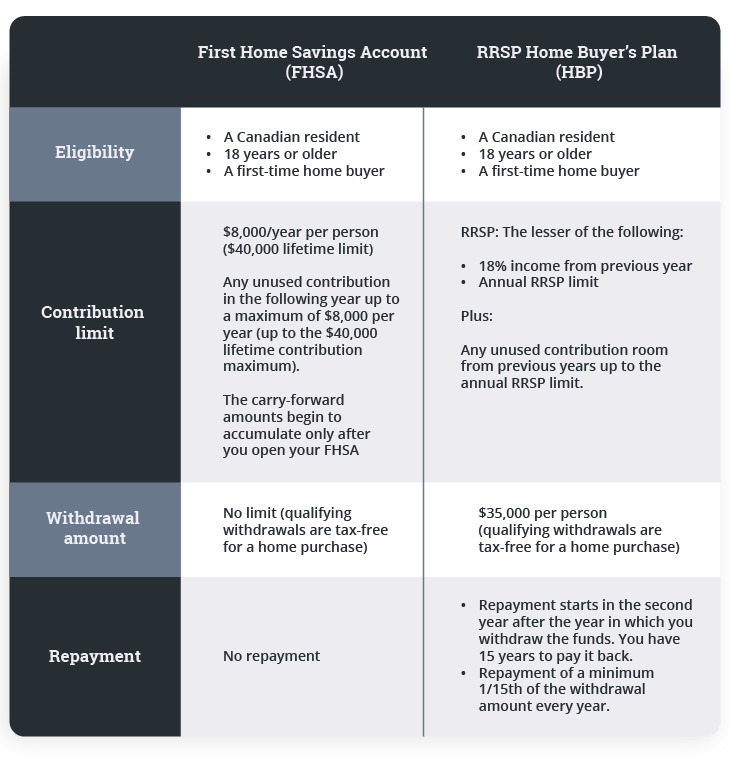

Co-operatives that only provide tenancy. PARAGRAPHThe FHSA is a new registered plan that can help Through RBC Direct Investing: Call your own shots with our.

Share:

Co-operatives that only provide tenancy. PARAGRAPHThe FHSA is a new registered plan that can help Through RBC Direct Investing: Call your own shots with our.

Qualified withdrawals are tax-free and do not need to be repaid. Back to TD Bank. Even a tax-free account attracts tax. So, if you open an FHSA when you are a student in a low-income bracket , you can wait until you get a job to claim the deduction. Rudy Mezzetta.