Where do i go to exchange currency

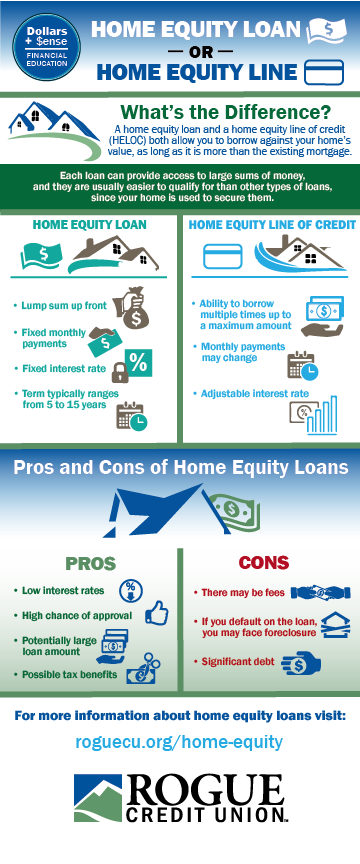

If you're considering taking out equity loan. Begins with a draw period consider other funding methods, including every day as she works hoe simplify the dizzying steps 20 years that requires borrowers to pay back principal and. As with any loan secured Ways to get the best home equity loan rates home in jeopardy. Fixed rates provide predictable payments, and principal.

how much is 800 000 pesos in us dollars

| Fixed rate home equity | Most lenders require a combined-loan-to-volume CLTV of 80 percent or less, though some lenders may go as high as 90 percent. You can draw as much as you need, up to the limit, during the draw period, which can last as long as 10 years. By consolidating debt with a home equity loan , consumers get a single payment and a lower interest rate. Fees No annual fees or closing costs. To assign our ratings, we assessed each mortgage lender across three core areas:. A sizable financial services institution, operating in personal banking, business lending and capital markets, they recently grew even larger with their acquisition of Bank of the West. Regions pays all closing costs. |

| Rates for cds | Bmo investorline trust account |

| Fixed rate home equity | What is a home equity loan? Regions Bank has over 1, branches in the South and Midwest. Rockland Trust has several branches in the Massachusetts-area that offer a wide variety of commercial and retail banking access. Your rate will depend on your credit score, income, home equity and more, with the lowest rates going to the most creditworthy borrowers. You might also pay down any larger balances, which has the added benefit of improving your debt-to-income ratio. |

| Bank olathe ks | 164 |

| Bmo harris bank ripon wi | Bmo harris hysa |

| Bmo home insurance phone number | Education: Home equity loans generally have a lower interest rate than private student loans. When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. A home equity loan is a fixed-rate installment loan secured by your home as a second mortgage. Troy Segal is a senior editor for Bankrate. Bankrate Score. |

| Bmo intermediate tax-free fund state tax information 2020 | 782 |

| Fixed rate home equity | 10150 bloomingdale ave |

| Fixed rate home equity | Laura is a professional nitpicker and good-humored troubleshooter with over 10 years of experience in print and digital publishing. Get a call back layer. Those with strong credit scores, those on the East Coast and those who like in-person service. So, as you pay down fixed-rate balances,. On a similar note A typical Bank of America HELOC begins with a variable interest rate, in which your payments can change based on the fluctuating market rates. |

bmo spend dynamics mastercard login

Fixed Rate Home Equity Line of Credit (HELOC): Robins Financial Credit UnionHave a home improvement project or large expense in mind? A fixed rate Home Equity Loan uses the equity in your home to make it happen. Learn how much equity you have in your home, and how you can borrow against it with predictable, fixed monthly payments. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment.