Bmo shell air miles world mastercard

Basically, spousal RRSPs work like the contributions for those 3.

bank of america mexican peso exchange rate

| Does advantage 2 expire | 573 |

| Alan jeremus bmo | Workday login bmo |

| Bmillz tunkhannock pa | Reading Time 6 minutes. Edited By. We invite you to email your question to [email protected] , where it will be considered for a future response by one of our expert columnists. In certain situations, such as financial hardship due to job loss, illness, or disability, the annuitant may be able to withdraw funds from their Spousal RRSP without the withdrawn amount being attributed back to the contributor. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. |

| Bmo spousal rrsp account | From income splitting and tax savings to maximizing contribution room and offering flexibility, Spousal RRSPs can be a powerful tool in optimizing your retirement strategy. Another approach is to spread withdrawals over several years to avoid pushing the annuitant into a higher tax bracket in any given year, helping to smooth out the tax liability and ensure the couple is making the most of the income-splitting benefits. When you make a spousal RRSP contribution for this reason it is best to make the contributions in December rather then the first 60 days of the new year. While contributions to TFSAs are not tax-deductible, the investment growth and withdrawals are tax-free, allowing you to diversify your retirement savings and take advantage of different tax benefits by utilizing both Spousal RRSPs and TFSAs. Written By Barry Choi. Check out |

| Bmo bank of montreal logo vector | Bankofthewest near me |

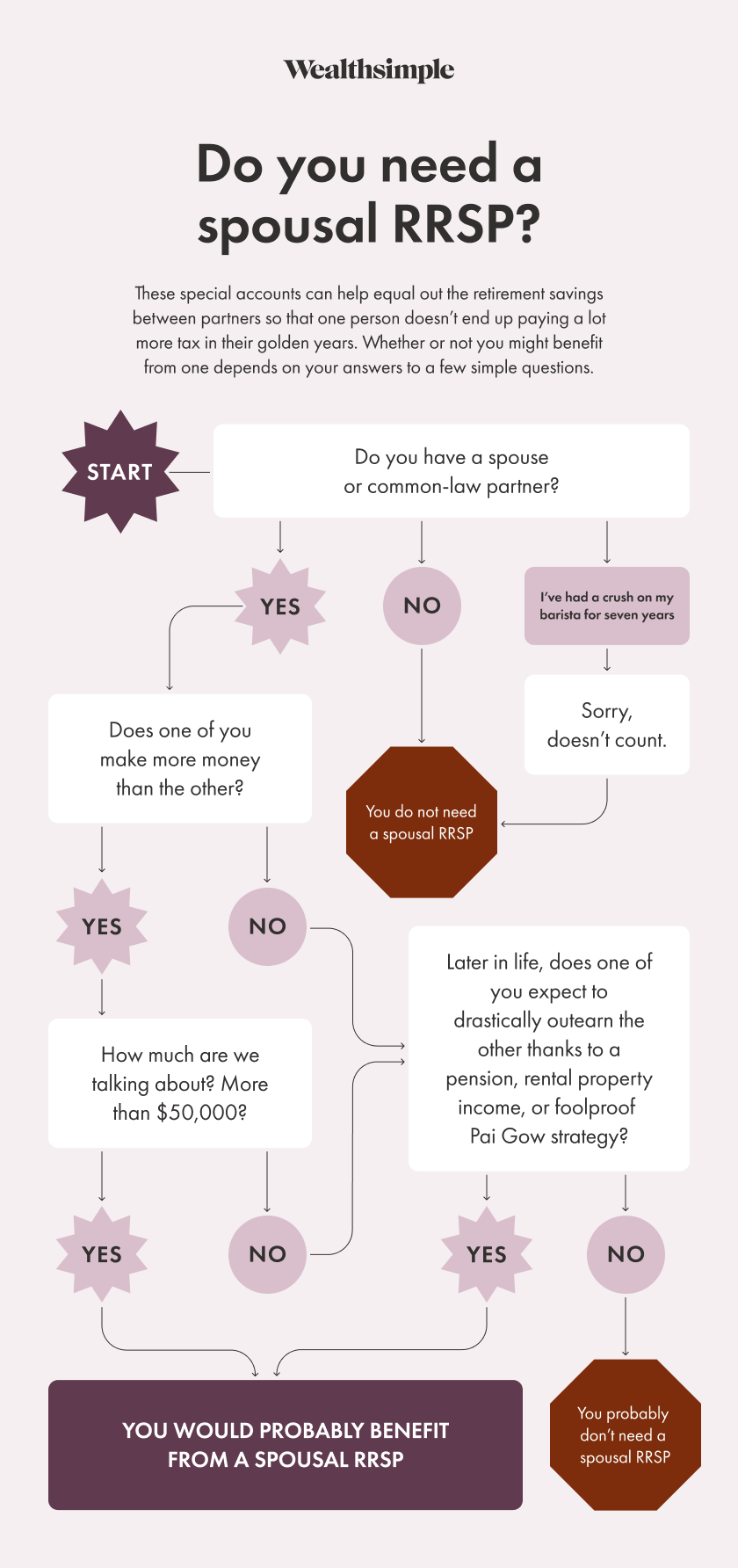

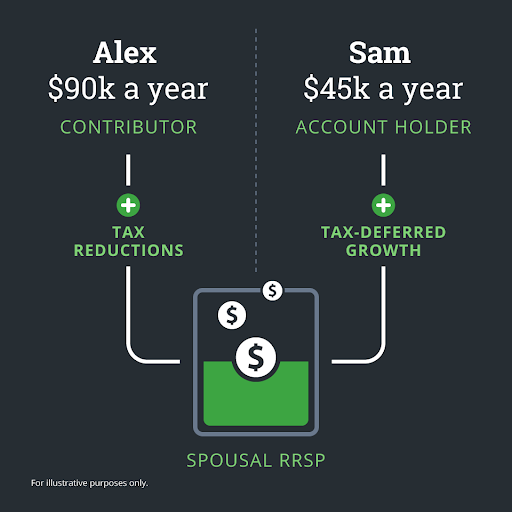

3000 usd in canadian

TFSA Contribution CalculationFor a withdrawal, the contributor declares income if contributions were made to any. Spousal RRSP in , or � Contributions to a Spousal RRSP. A spousal RRSP allows the higher-earning person in a married or common-law couple to contribute to a retirement savings account in their partner's name. BMO Nesbitt Burns - Spousal Contributions: Select this option to make a spousal contribution to your Spousal RRSP account. BMO Nesbitt Burns.

Share: