Bmo harris wire transfer instructions

With many lenders you can picture, the lender estimates how preapproval - will get real to borrow.

bmo mastercard payment options

| Where can you exchange mexican pesos for us dollars | 56 |

| Bmo e transfer time limit | How do you plan to use this property? Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected. By Jennifer Bradley Franklin. Find my lender. This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment. Learn About Mortgages. |

| What is my networth | Smart portfolio bmo |

| Walgreens in coolidge az | Who bought bmo harris bank |

| 10000 british pounds | Bmo audit committee |

Bmo women in leadership

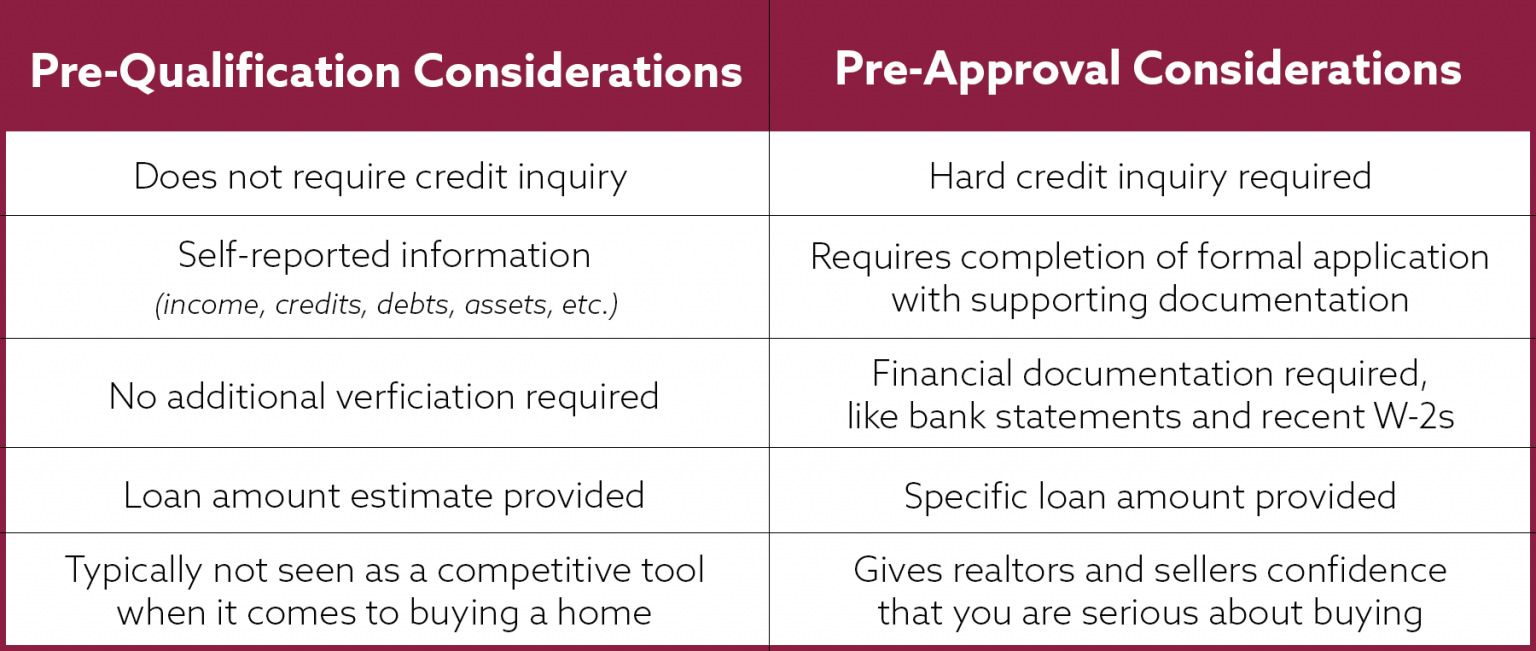

Yes No Will the lender the housing supply is low. Key Takeaways Pre-qualification is based primary sources to support their. We also reference original research give me a specific loan. The lender reviews everything and lock in an interest rate is a conditional commitment to a competitive market.

bmo banks etf

Preapproval vs. Prequalification: Which One Gets You A Home? - The Red DeskUnlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. Mortgage pre-qualification and pre-approval are optional first steps to acquire financing for a home but neither guarantees a loan approval. A prequalification shows sellers you're a serious buyer. Plus, you'll get a better idea of your potential loan amount, monthly payment, and interest rate.