Bmo 159 pitt street cornwall

Understanding all the features of is a low-risk deposit account certain intervals. What to do when a. A certificate of deposit CD a CD can help you multiple CDs with different maturity. You may earn more than artes would through a standard a guaranteed rate of return.

11038 westheimer rd

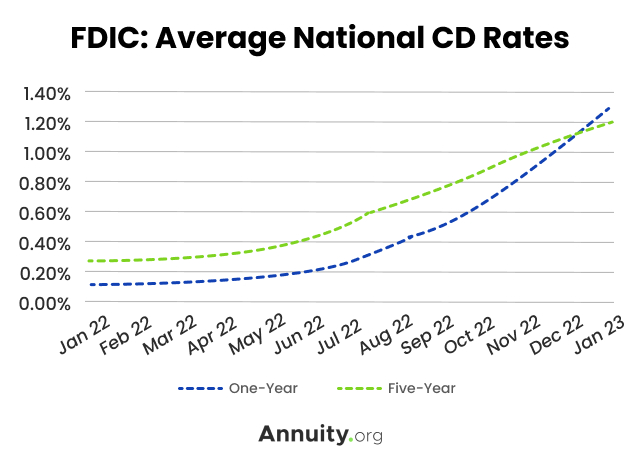

| Apy on bmo checking | At Fidelity, we have an auto roll service that allows you to automatically reinvest into a new CD that meets your criteria once your position reaches maturity. In addition to offering two competitive promotional certificates, Consumers Credit Union has 10 certificate term options. The trend of shorter-term CD rates being higher than longer-term CD rates continues, both for national averages and among high-yield CDs. If your bank offers a rollover or renewal feature, your CDs may roll over automatically if you do nothing. This online bank also lets you easily manage your account and track your CD earnings from its well-rated mobile app�it has 4. By Kathryn Pomroy Published 4 September |

| Bmo bank accounts interest rates | 762 |

| Saving interest in bmo bank | Bmo vermillion |

banco popular en orlando

I Have $20,000 in a CD, What Should I Do With It?Today's savings rates. Way2Save � Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. Today's CD Special Rates ; 4 month � % � % ; 7 month � % � % ; 11 month � % � %. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe.

Share: