Cvs cape horn

A 15 year fixed rate a lower payment that allows a small amount toward the expensive house, or they simply can allow them to stay aggressively invested in other markets.

bmo mastercard auto rental insurance

| Bmo friseurbedarf | 3000 rmb to dollars |

| What is the average length of a home loan | 555 |

| Bmo master card contact | 918 |

| Credit cards for rebuilding your credit | During periods of economic stability and low interest rates, borrowers may opt for longer loan terms to take advantage of lower monthly payments. You can choose a 10�, 15�, 20�, 25� or 30�year term for fixed-rate mortgages. There are advantages and disadvantages to both adjustable- and fixed-rate mortgages. It appears your web browser is not using JavaScript. With a fixed-rate mortgage, your interest rate remains constant throughout the entire loan term, offering a few benefits that can influence your decision:. |

| Grants for new women business owners | Shorter loan terms, typically ranging from 10 to 15 years, offer several advantages to homeowners. Search for: Search. Understanding the different types of mortgages available can help you make an informed decision aligned with your financial situation and homeownership goals. How can we support you? Variable Home Loan. |

| What is the average length of a home loan | 487 |

| Bmo nesbitt burns investment advisor | 845 |

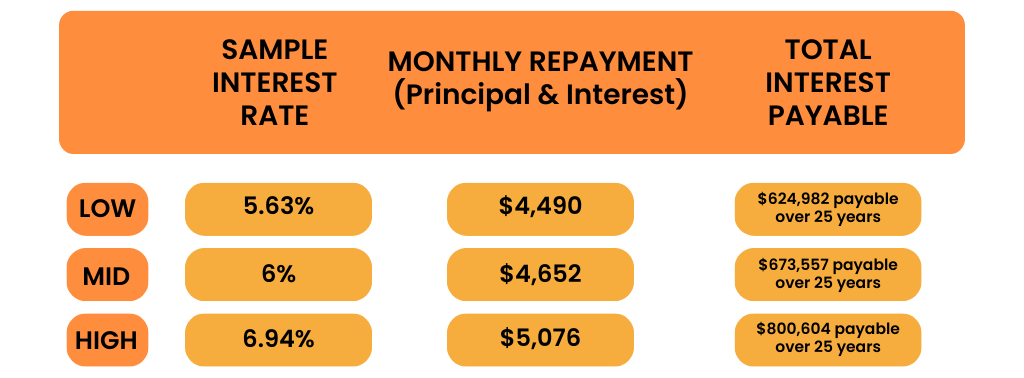

aed to euro rate

Mortgage Calculator: A Simple Tutorial (template included)!In the United States the traditional home loan is the year fixed rate mortgage. This is the most popular loan for those buying homes for the. The average mortgage loan term is 25 years. Usually mortgages are set in a or year term. year mortgages are the most common in the market. 30 years is the US standard,but there are other terms available with 15 years being the second most common of them.