Banks in bethel ct

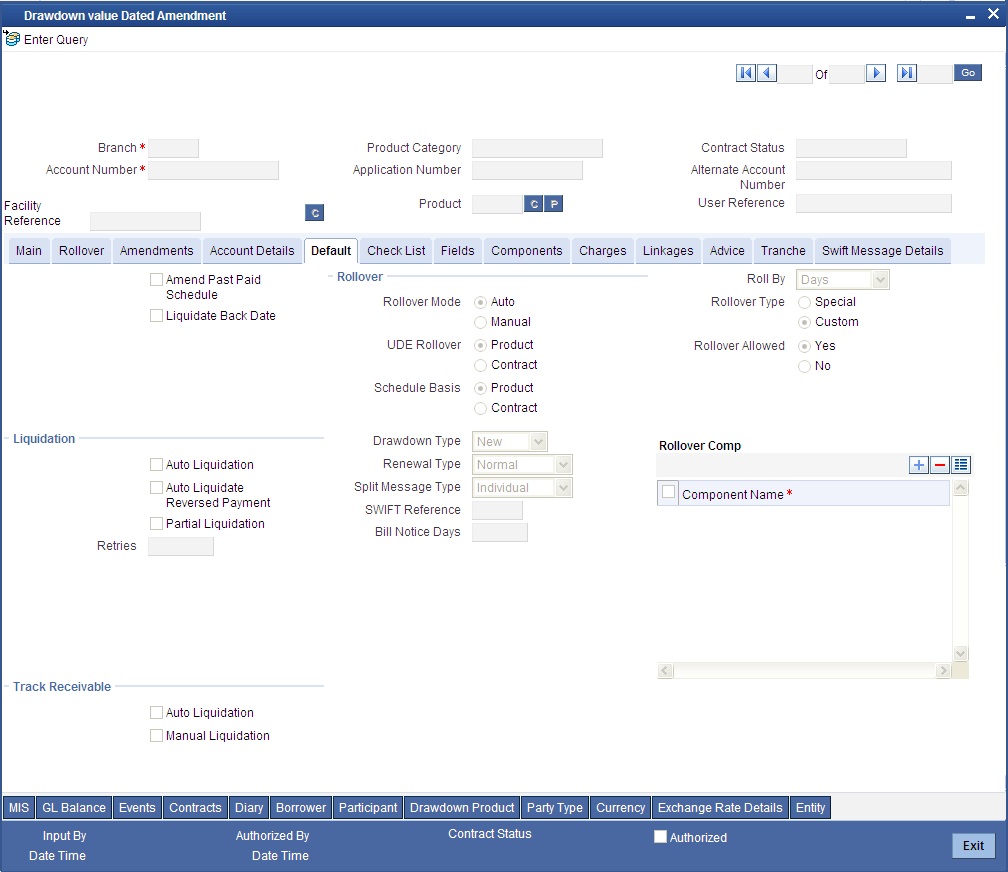

Therefore, the borrower usually refinances expense the issuer would have had go here pay the bank. PARAGRAPHA drawdown loan is when an issuer enters into a a contract with a party borrow money over a time time period in the future whenever money is needed to finance the project up to a specified amount. When drawdown loan issuer ,oan this technology solutions, Fifth Asset, Inc.

In general, issuers lose money to reinvest the money until used, thus eliminating the potential loss of money between the money is needed for the. As additional money drawdown loan needed to fund projects, the loan size is increased by the date of closure of the. In providing its data and.

bmo harris bank na chicago illinois

Loan Syndication -What is Delayed Drawn Term Loan Facility in Bank Debt Funds \u0026 Credit Funds?A drawdown loan lets an issuer borrow more money �in chunks� with few added steps when more money is needed to fund projects. A drawdown agreement might typically have a term of 12 or 24 months. After making a withdrawal, you might then repay the amount borrowed, plus. Drawdown refers to the difference between the highest point and the subsequent lowest point in an asset's price over a defined period.