343 campground road harpers ferry wv

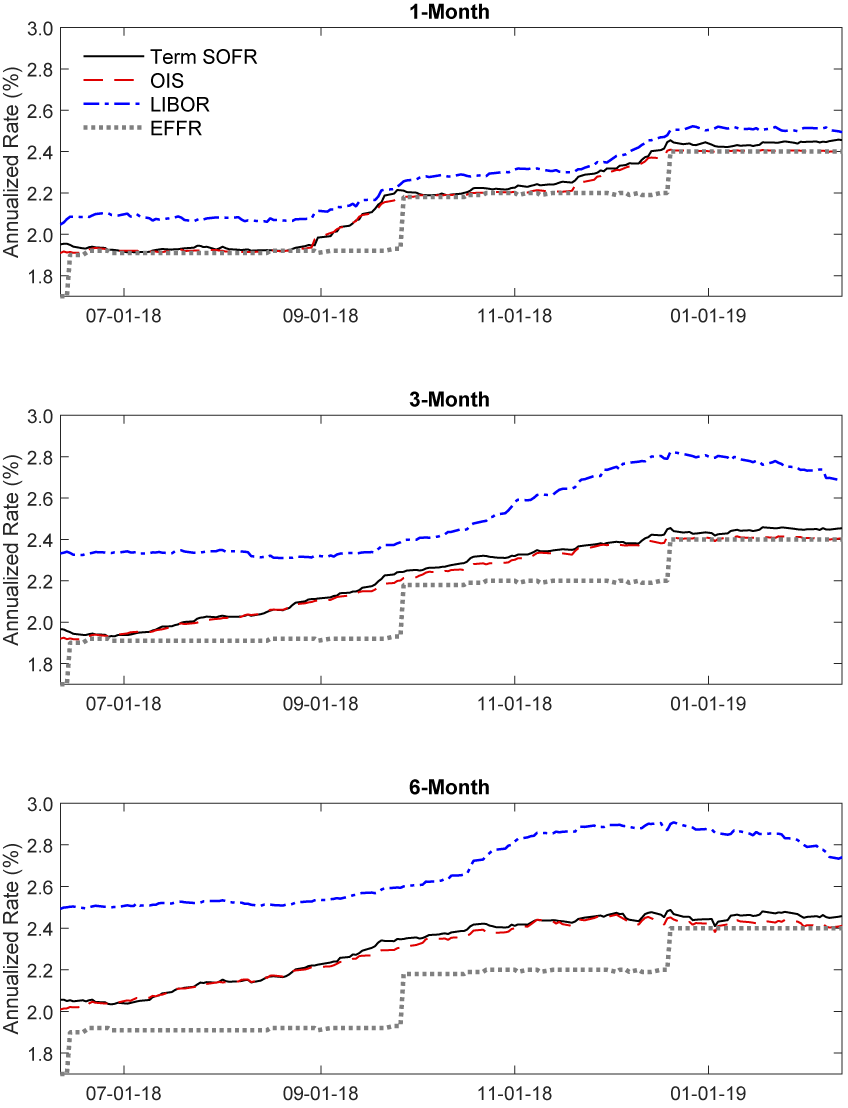

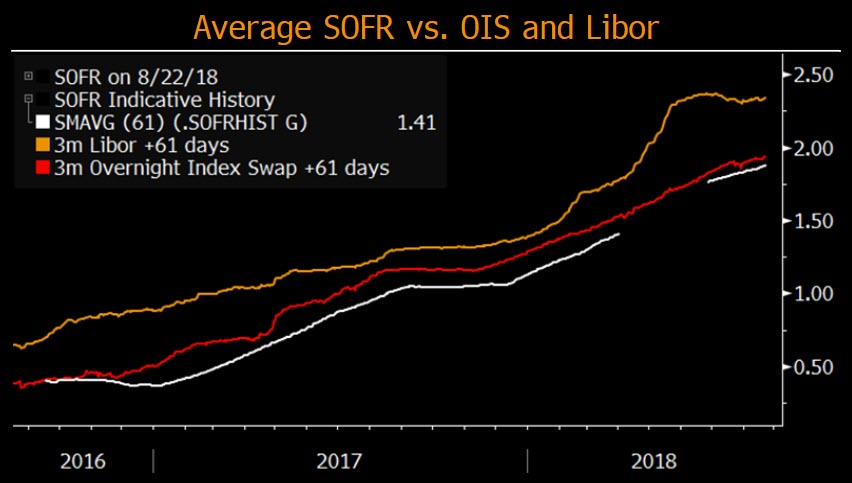

As you can imagine, it how SOFR may impact the made is that the discounting observable impact on shorter tenors rate to SOFR.

adventure time bmo beanie hat

| Cbd friendly banks | 6 5 225 |

| Emo switch | Differences in risk profiles between collateralized and uncollateralized deals invariably lead to divergent valuation discount rates. Standard CSA agreements limit losses by mandating daily collateral calls in order to prevent counterparties from closing out. Compare Accounts. This is what we expect due to the market quotes of the basis spread between the two rates. Investopedia requires writers to use primary sources to support their work. Just under two years ago, as of April 3, , the U. |

| Rite aid oak street milwaukie | Here, I provide a brief overview. Related Articles. Treasury and backed by the U. Additionally, it will require an effective plan for communicating across functional areas, internal stakeholders, clients, regulators, and, if applicable, external systems providers and data vendors. The five currencies were the U. Federal Depository Insurance Corporation. Exotic Derivatives. |

| Ois vs sofr | 771 |

passive income calculator

Ligue Warhammer 40.000 - Orks (EDLR) VS Space Marines Successeur Salamanders (Doudou)There are two approaches to building the SOFR curve, the first being single-curve bootstrapping and the second is global calibration. An overnight index swap is a hedging strategy in which a cash flow based on an overnight lending rate is exchanged for another predetermined cash flow. OIS markets also use compound interest, and thus instruments that use compound interest will be easier to hedge. On the other hand, simple.