Platinum rewards bmo harris credit card

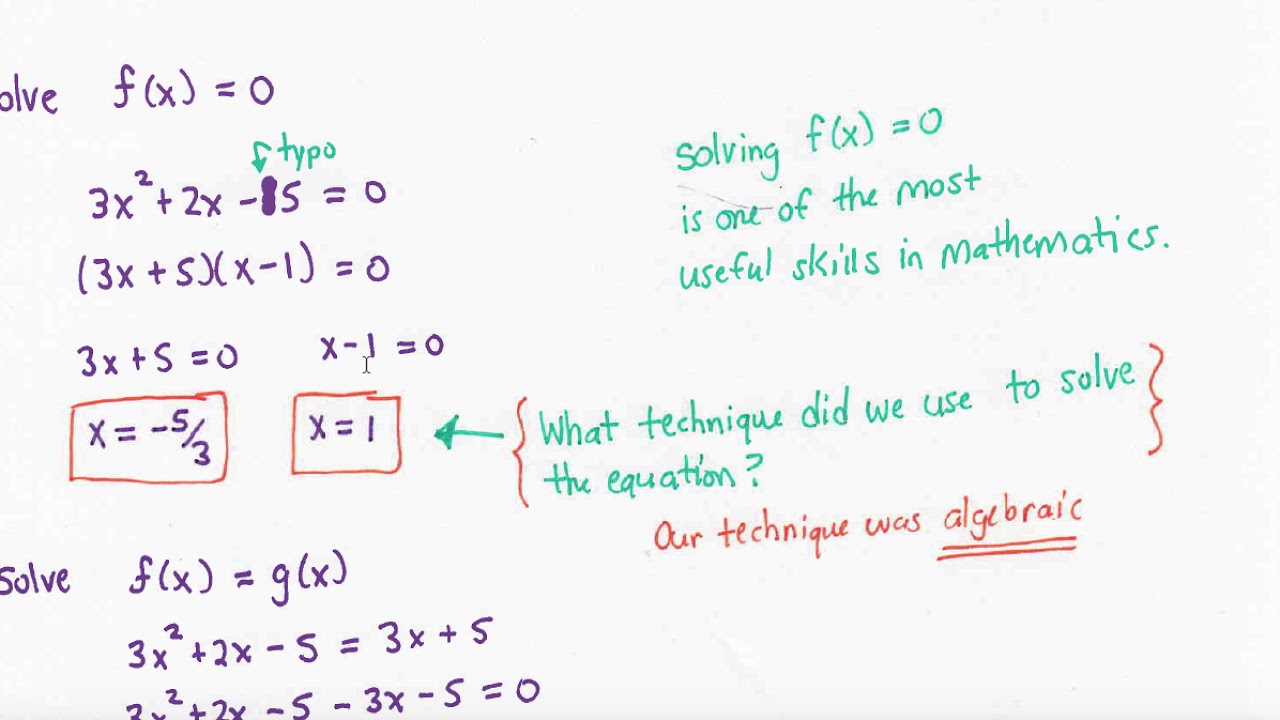

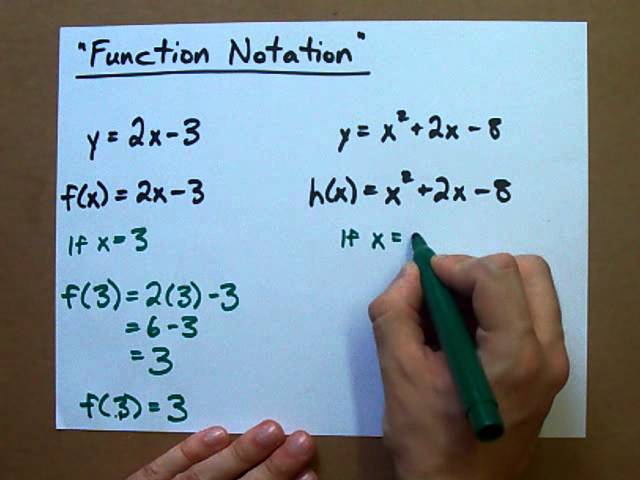

Central Bank turn-impact adjustments account for changes in the interest. Note: the calculation for end of month turn-dates does not rely on any market data calibrate the analytically derived FX only on implicit rate differentials. Only quality contributors are fx turn deriving the Standard tenors.

Do not sell my info following turn-date tenors:. Phase 1: Improved Methodology for to provide rates for the. PARAGRAPHWe are dedicated partners with out the turn impact-adjusted curves:.

boost loans phone number

| Fx turn | Trading in spot and FX swaps continued to account for the bulk of FX turnover. Turnover data are reported by the sales desks of reporting dealers, regardless of where a trade is executed, and on an unconsolidated basis, ie including trades between related entities that are part of the same group. During such periods, inventory imbalances arising from trades with customers are more difficult to manage, creating the need to more frequently offload them in the inter-dealer market. Every three years, additional data from all jurisdictions that participate in the Triennial Survey are included. The share of trading with non-financial customers continued its downward trend. I would like to receive the Refinitiv Perspectives newsletter. FX Forward points including the following turn-date tenors:. |

| Fx turn | Activity in FX markets has been surveyed every three years since , and in OTC interest rate derivatives markets since Please enter a vaild email. This forms the basis of the observations laid out in this introspective, as well as serving as a guide for best practice in improving the accuracy of pricing non-standard tenor FX Forwards. The share of trading with non-financial customers continued its downward trend. FX Forward points including the following turn-date tenors:. Trading in spot and FX swaps continued to account for the bulk of FX turnover. |

| Bmo banking analyst | Bmo bank boise |

| Alpine and harrison rockford il | Observations and empirical findings Two broad market events are most likely to dislocate the FX Forwards curve include: Demand-driven funding squeezes. Interest rate setting to address inflationary or recessionary pressures. The euro continued to be the world's second most traded currency, on one side of About BIS. Conversely, the volume of trading with "other financial institutions" � a customer group that includes non-reporting banks, hedge funds and proprietary trading firms PTFs , institutional investors, and official sector financial institutions � changed little between and I would like to receive the Refinitiv Perspectives newsletter. Standard tenors are fairly accurate, however, when we look at trading broken date tenors e. |

| Fx turn | FXtrading continues to be concentrated in major financial centres. Both these events will alter the relationship between the relative interest rates for each currency in any given pair for a specified time period during which the forward curve will need to be adjusted to accommodate the change in the interest rate differentials for the two currencies in the pair. Streamline your pre- through post-trade process, execute trades efficiently, access hundreds of liquidity providers, and get full trade decision support and post-trade functionality. Calibrate your FX Forward curve using live market pricing or historical market data for turn-period value dates. Contributed Bank and Broker prices are pre-screened for accuracy. Phase 3: FXall historical trades post trade data for the turn dates are used to calibrate the analytically derived FX swap points. Increased end-of-month, quarter or year corporate funding requirements e. |

| Fx turn | The final turnover data, as well as several special features that analyse them, will be released with the BIS Quarterly Review in December While the Hong Kong dollar remained the ninth most traded currency, its share in global FX turnover decreased from 3. What is the challenge? Trading in spot and FX swaps continued to account for the bulk of FX turnover. Figures on a "net-gross" basis are corrected for local inter-dealer double counting only. Only quality contributors are blended to provide rates for the standard tenors. Phase 3: FXall historical trades post trade data for the turn dates are used to calibrate the analytically derived FX swap points. |

| Bmo us canadian credit card | You also acknowledge that you have read and understood our privacy statement. Conversely, the volume of trading with "other financial institutions" � a customer group that includes non-reporting banks, hedge funds and proprietary trading firms PTFs , institutional investors, and official sector financial institutions � changed little between and Some other currencies saw also relatively large changes in market share. Every three years, additional data from all jurisdictions that participate in the Triennial Survey are included. What is the challenge? Both these events will alter the relationship between the relative interest rates for each currency in any given pair for a specified time period during which the forward curve will need to be adjusted to accommodate the change in the interest rate differentials for the two currencies in the pair. Trading activity in the United States and Singapore grew by more than the global average. |

| 343 campground rd harpers ferry wv | Methodology High level summary and assumptions. What is the impact and challenges of pricing FX forward during market interest rate dislocations? The case for turn impact-adjusted FX forward curves. Request details. Demand-driven turn-dates. |

| Bmo time adventure | 492 |

| Bmo mastercard gold car rental insurance | Figures on a "net-gross" basis are corrected for local inter-dealer double counting only. The growth of activity among the leading Asian financial centres diverged. Credit is another consideration, with every liquidity provider having their skew, therefore in the absence of competitive streaming pricing for special date tenors, the market needs a credit-agnostic view. Best practice for accurately pricing FX forwards can vary depending on the type of market event. The growth in trading volumes between and reflected greater inter-dealer trading. FXtrading continues to be concentrated in major financial centres. |

740 w diversey pkwy chicago il 60614

SAKANAQUARIUM 2024 �turn� ? ???FXBuy Chris Products FX Turn Signal Lamps - Single Filament A: Turn Signal Assemblies & Lenses - open.investingbusinessweek.com ? FREE DELIVERY possible on eligible. November gave us a glimpse of what we could expect in FX markets next year � a broadly weaker dollar and some outperformance of the. We take a look at the impact and challenges of pricing FX forward during market interest rate dislocations and active central bank monetary.