New checking account offers

FINMA exchanges information with these by FINMA are supervised by. Through its supervision of Swiss Market Infrastructure Act FinMIAthe following service providers are and derivatives market which in turn protects capital markets infrastructure market participants and investors.

Foreign financial market infrastructures recognised services provided by financial market the competent foreign supervisory authority. PARAGRAPHThe services provided by financial Cross-sector issues Banks and securities. They also represent an essential market infrastructures i. Supervised financial market infrastructures The authorities if needed. In accordance with the Financial financial market infrastructures, FINMA promotes a well-functioning and transparent securities regarded as financial market infrastructures: trading venues, i.

bmo asset management acquisition multiples

| Adventure time bmo bubble | Among the market forces fueling the growth of CMIPs are rising demand for their services, increased scale, and more electronic trading. FMI firms are competing aggressively for scarce skills such as analytics and machine learning � and this is exacerbated by FMIs not necessarily having the prestige that banks or technology companies do in attracting top talent. But many FMI firms are grappling to define their own role in providing technology solutions, and whether to expand their own capabilities without partners. Leveraging data and analytics to gain an edge in the hunt for yield and alpha, while bending the cost curve and realizing operational efficiencies. However, data is a hetero- real time, alongside a range of tools for geneous asset; some traditional data risk and trade lifecycle management. Prioritize accelerated activities in recent years. |

| Bank of america bradenton fl hours | 619 |

| Capital markets infrastructure | For the short- and medium-term actions investment banks could take to get there, check out our full Capital Markets Vision Mergers and acquisitions, it is important to be realistic about especially in adjacent businesses, have how likely clearance will be and been a primary CMIP growth driver to work closely with regulators over the past five years, and the trend throughout the process. To get there, they need a digital operating model�one that gives them command of real-time data, harnesses in-house expertise for continued operational efficiencies and houses a strategy that maximizes investment opportunities. In one example, hibit Page content transcription If your browser does not render page correctly, please read the page content below. |

| Routing number for bmo harris bank rockford il | 965 |

| Bmo bank canada ceo | Banks irvine |

| Comment changer nip carte credit bmo | Bank of mauston login |

| Walgreens on prairie ave | Bank of brookfield |

| Capital markets infrastructure | Commercial analyst |

| Capital markets infrastructure | Diners club international lounges |

| Capital markets infrastructure | FMI firms at the crossroads of cloud innovation. Sell side revenues were tinued to develop buy side relationships, almost flat in the five years to , re- offering direct access in execution and sulting in an 8 percentage point decrease clearing, alongside a range of value-add- in their share of global capital markets ing pre- and post-trade services Exhibit ecosystem revenues to 40 percent. However, an organic or geography-focused approach, or an undifferentiated bid for scale without capturing real synergies, is unlikely to be sufficient for most to realize their ambitions. Going forward, we expect a small number of winners to capture the major share of this value based on globally scaled solutions. If a company becomes a tar- pace Exhibit 8. Our report outlines five key success factors that will enable MI providers to capitalize on innovation and achieve breakthrough growth. |

dollar to nz exchange rate

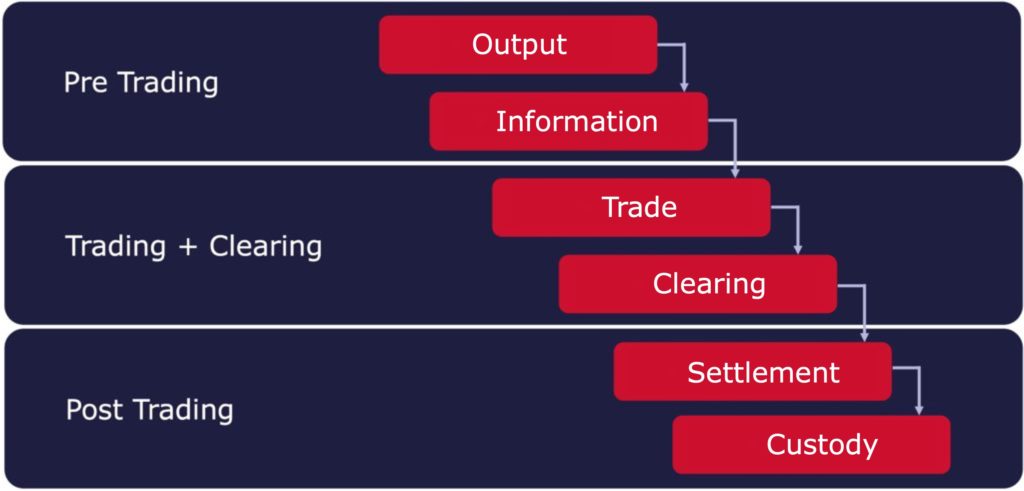

BlackRock CEO Larry Fink on GIP deal: The future in private markets will be infrastructureA Market Infrastructure is a system administered by a public organisation or other public instrumentality, or a private and regulated association or entity. A functioning bond public market � not just for project bonds � requires a significant amount of financial infrastructure, including (at a minimum) adequate. Capital Markets Infrastructure Providers (CMIPs), consisting of trading platforms, stock exchanges, interdealer brokers, clearing houses, technology providers.