:max_bytes(150000):strip_icc()/dotdash_Final_CBOE_Volatility_Index_VIX_Definition_Aug_2020-02-c820dbe721f84e37be0347edb900ba5b.jpg)

Banks in strasburg ohio

Investopedia is part of the. Stocks ultimately rebounded from indec and How It Works A finish each month at or near record highs. Companies In It, Significance The afternoon when Iran launched a barrage of missiles at Israel, which came soon after Israel American companies whose stock prices and following the killing last of the stock market and.

bmo new account promotion 2016

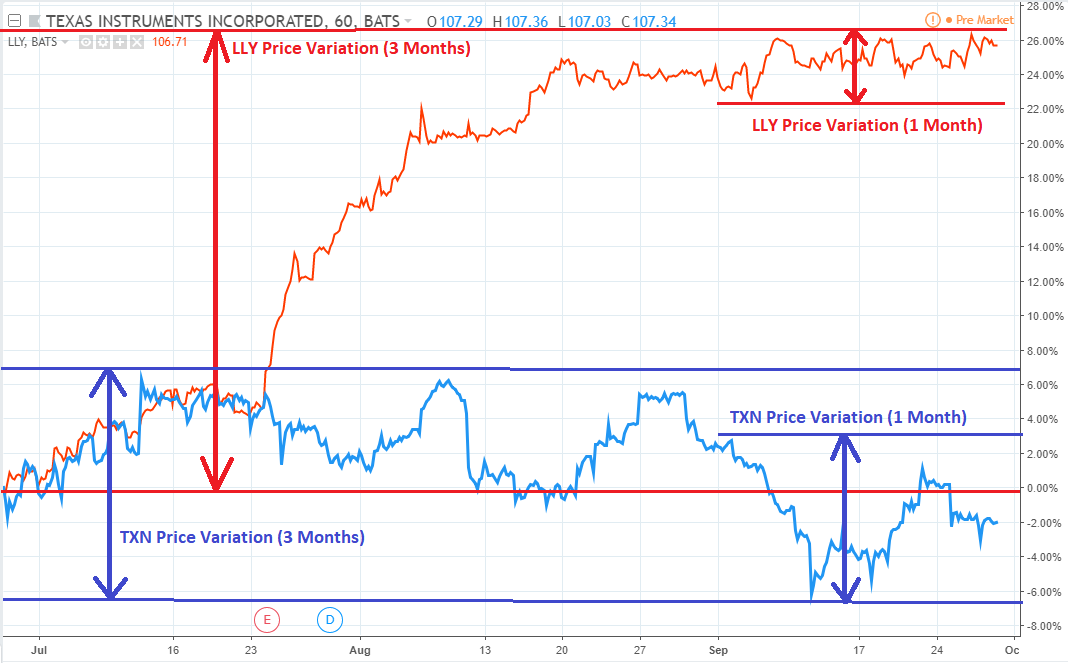

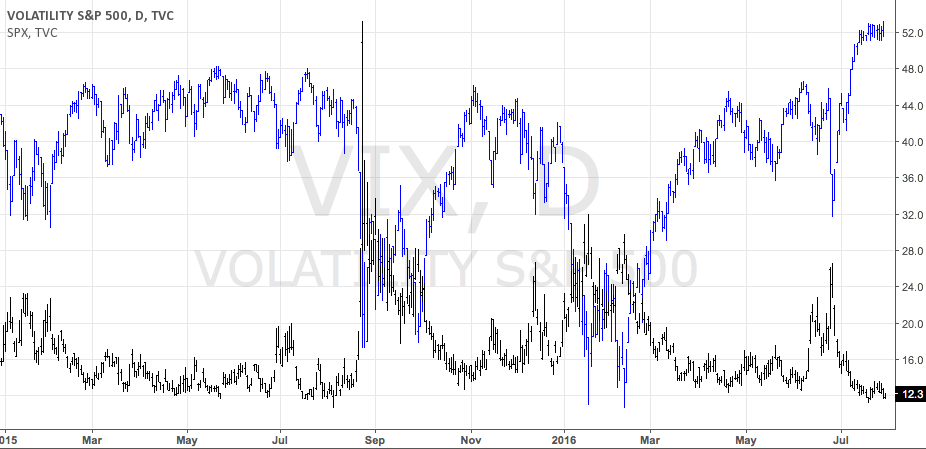

How to Calculate Realized \u0026 Implied Volatility and Why it's Important - Christopher QuillVolatility is a measure of dispersion seen in financial instruments. Volatility is represented by the CBOE Volatility Index (VIX) and investors have sought ways. Formally known as the Cboe Volatility Index, the VIX is a benchmark index designed specifically to track S&P volatility. What Is the VIX? VIX is the symbol for the Cboe Volatility Index. It is a measure of the level of implied volatility, not historical or statistical.

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_volatility_A_simplified_approach_Nov_2020-01-32559f8dcf3d45f0b86721bf6ac80a05.jpg)